How to set and reach your financial goals in 2025 : Got things you want to achieve in 2025 . Find out how you could set and reach your financial goals this year.

Make a note of what you want to do

A helpful first step is to know what you want to do this year. Are you hoping to pay for a holiday, clear credit card debt, or save more for your long-term future in 2025? If so, how much money will you need – and when?

You could jot this information down in a notebook or type it in a spreadsheet . You may even choose to make a vision board’-a collage of images and words representing your ambitions for the year. How you do it is up to you, but having your goals written somewhere can help keep you motivated.

If your goals involve your loved ones and you’re going to be splitting costs, it’s usually worth talking to them and making sure you’re on the same page.

http://How to set and reach your financial goals in 2025

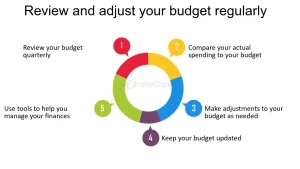

Create or review your budget

A budget can come in handy when you’re trying to reach your financial goals. Budgeting typically involves looking at how much money you’ve got coming in and how much you’re spending each month (think, utility, bills, etc) . Once you have a clear picture of your current financial situation, you can then factor your goals into your budget. How much could you realistically afford to put towards your goals, and will this amount be the same each month?

Consider ways of saving and investing

It’s worth looking into how you could potentially make your money work harder for you in 2025. If you’ve earmarked money for a particular goal, you might consider putting that into a savings account, where you can usually earn a bit of interest. There are different ones you could go for , including, but not limited to, easy-access savings accounts or cash ISAs (ISA stands for ‘ Individual Savings Account’).How to set and reach your financial goals

Or you could invest your money, and potentially achieve investment growth on it over time.How to set and reach your financial goals There are different ways to invest, including Stocks and Shares ISAs. Remember, the value of investments can go down as well as up and you could get back less than was paid in. What’s right for you depends on your goals. To find out more about the difference between saving and investing, check out Money Helper.

Some products are designed to help you save for specific goals. For Example , a lifetime ISA can be used to help you buy your first home . You can read more about these, and other types of ISAs, on the government’s website.How to set and reach your financial goals

Automate your savings (or investments)

There are ways you can automatically move money out of your current account, meaning you don’t need to think too much about it. You may be able to set up a standing order with your bank to transfer money between accounts. Or you could look into apps and online tools that automate your savings and investments.

It’s also worth checking in on how your savings and investments are doing throughout the year to see if you’re on track for your goals.

Think about the end of the tax year

5 April 2025 is the last day of the current tax year. This is an important date to keep in mind, particularly if you’re continuing to pay (or aiming to pay more) into a pension plan before then. Why does this matter?

Unless you have particular protections, the annual allowance is usually $60,000 or your total salary whichever is lower. But a different annual allowance might apply to you if you’re a high earner (usually if you have income over $200,000) or you’ve already started taking money from a pension plan, so make sure you check. You can visit Money Helper to learn more about pension allowances.

If’s worth checking that you’re still comfortable with your payments before the tax year ends. If you still have some allowance left and want to make the most of your plan’s tax benefits, you might decide to increase your monthly payments or top up your plan with a single payment. If you’re a Standard life customer, you can usually make a single payment online or on our app, and you might be able to change your monthly payments this way too. Or if your employer set up your plan , speak to them to find out how to change your monthly payments.