5 Personal Financial Planning Tips to Live By

5 Personal Financial Planning Tips to Live By: Financial planning planning is a proactive approach to managing your finances and achieving long-term financial goals. By establishing a comprehensive plan, you can effectively allocate resources, prepare for significant life events and make informed decisions that support you overall financial well-being. Whether you’re saving for retirement, funding education expenses, or building an emergency fund, a well-crafted financial plan serves as a roadmap, guiding you toward financial stability security.

What Is Financial Planning?

5 Personal Financial Planning Tips to Live By: Imagine you’re planning a cross country road trip. Financial planning will help you map out your budget for expenses so that you can save enough to reach your destination safely and comfortably.

The planning process typically involves a comprehensive evaluation of an individual’s current financial situation, future expectations and objectives. It then calls for the development and implementation of a personalized plan to meet those goals and mitigate potential risks.

The planning process typically involves a comprehensive evaluation of an individual’s current financial situation, future expectations and objectives. It then calls for the development and implementation of a personalized plan to meet those goals and mitigate potential risks.

5 Personal Financial Planning Tips to Live By

Here are 5 tips to help you create a financial plan, and hopefully, improve your financial outlook:

1. Set Financial Goals

5 Personal Financial Planning Tips to Live By: Setting clear and specific financial goals is the foundation of effective personal financial planing. It provides direction and purpose to an individual’s financial decisions and actions. Financial goals can be diverse and tailored to an individual’s unique circumstances and aspirations.

Long term goals may encompass objectives such as saving for a child’s college education, buying a home, starting a business, or accumulating a substantial retirement nest egg.

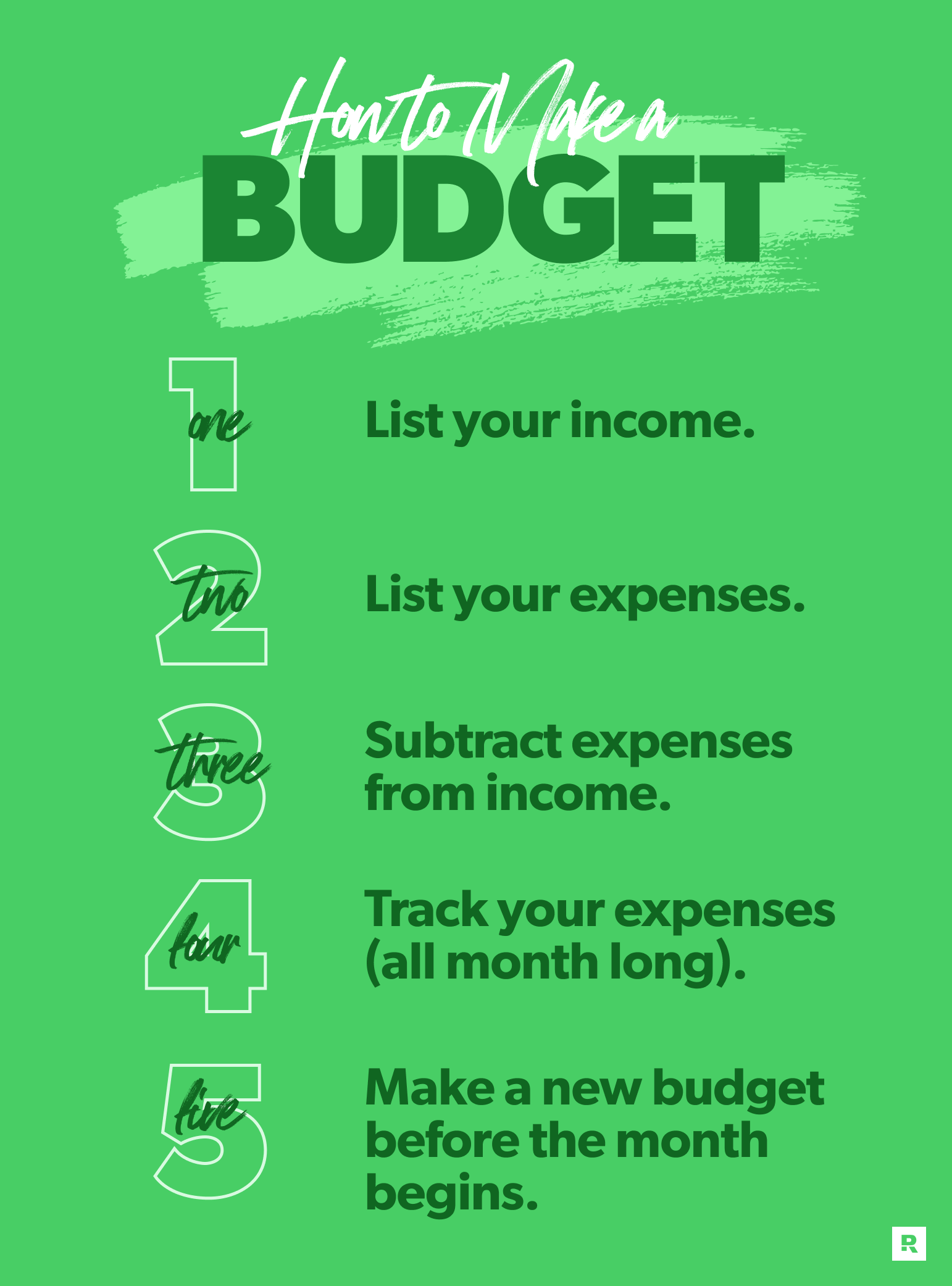

2. Make a Budget That You Can Follow

5 Personal Financial Planning Tips to Live By: When creating a budget, it’s important to be realistic. An overly restrictive budget that doesn’t allow for any flexibility or enjoyment can be challenging to stick to and may lead to frustration and abandonment of the budget altogether.

To create a budget, start by tracking your income from all sources, such as your salary, investments or rental income. Next, list all your expenses, including fixed costs like rent or mortgage payments, as well as variable expenses like groceries, entertainment and discretionary spending.

3. Build an Emergency Fund

5 Personal Financial Planning Tips to Live By: An emergency fund is a crucial safety net designed to cover unexpected expenses, such as medical bills, car repairs or job loss. Financial experts generally recommend having an emergency fund that can cover three to six months’ worth of living an emergency fund that can cover three to six months’ achieved by automating savings through direct deposits or transfers from each paycheck into a dedicated saving account, or by allocating a portion of any windfalls or bonuses toward the fund.

4. Save Early and Often for Retirement

5 Personal Financial Planning Tips to Live By: Retirement planning should be a top priority at all stages of your career. By starting to save early and contributing consistently to retirement accounts, you can take advantage of compound interest and potentially accumulate a substantial nest egg for your golden years.

For example, a 21 – year- old with no savings would only have to save just $360 per month in a 401(k) or IRA throughout their career in order to retire with more than $ million by age 67. That’s also assuming a very conservative 5% annual rate of return

It’s recommended to contribute at least 10-15% of one’s annual income toward retirement savings, adjusting this amount as necessary based on individual circumstances.

5. Avoid High Interest Debt

High interest debt such as credit card balances, payday loans and high interest rate personal loans can significantly hinder financial progress. Monthly debts payments can quickly eat away at your cash flow and keep you from saving and investing your money.

Therefore, you should prioritize paying off high interest debt as soon as possible, as the interest charges can accumulate rapidly and consume a substantial portion of one’s income.