2 Warren Buffett Stocks to Hold Forever

“When we own portion of outstanding

businesses with outstanding managements our favorite holding period is forever.”

-Warren Buffett, Berkshire Hathaway’s 1998 Letter to Shareholders

Warren Buffett has created incredible wealth for shareholders of Berkshire Hathaway. it’s been very inspiring to individual investors that he did it_as he alluded to in his 1988 letter to shareholders- by focusing on investing in quality companies and holding for the long term, without being fazed by occasional market volatility.

Here are tow stocks from Berkshire’s portfolio that can help you grow your savings for a richer retirement.

1.Apple

Berkshire has held a large position in Apple (AAPL 0.75%) since 2016. Despite recent sales in the stock,Buffett noted earlier in 2024 that Apple would likely remain Berkshire’s largest holding by the end of the year.indeed, Berkshire still held 300 million shares of the iPhone maker at the comparison, Berkshire’s next largest stock holding, American Express, was worth $41 billion.

in 2023, Buffett called Apple than any business Berkshire owns, and it’s easy to see why. Apple has a growing and loyal customer base, with many of the company’s customers owning multiple devices. From January 2018 through the start of 2024, Apple’s active installed base of devices increased from 1.3 billion to 2.2 billion.

Apple continues to attract new customers worldwide. in the most recent quarter, management reported that the active base hit another all-time high across all products and geographies.

This growth bodes well for the future of Apple’s services business, which generates much higher profit margins that sales of hardware products. Apple has been focused on investing to expand the quality and variety of services in recent years, which has led to more than 1 billion paid subscriptions on the company’s platform, and this is helping drive record revenue during a slow year for iPhone sales.

Apple’s revenue grew 2% in fiscal 2024 ending in September to reach $391 billion, mostly driven by a 13% increase in services revenue. The introduction of Apple intelligence could drive more upgrades, as it only runs on devices with a more recent processor. this remains a key catalyst for improving growth as Apple integrates artificial intelligence (AI) features across its products and services.

The high margins Apple generates from its products left the company with a massive $99 billion net profit last year. Apple has a lot of resources to reinvest in new products and services to drive long term growth. the stock has gotten expensive over the past year, but if you start a position and dollar cost average into it over time, you should earn solid returns.

2.Amazon

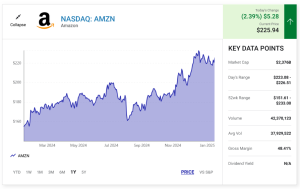

Berkshire held 10 million shares of Amazon(AMZN 2.39%) in Q3 and has held a position in the e-commerce and cloud computing leader since 2019.

Amazon continues to grow its online retail business, which generating profitable moneymaking opportunities in other services.

Amazon’s massive lead in e-commerce, with 6 times the market share of its next closest competitor, positions it well for term growth. Recent trends in consumer spending have made it difficult for Amazon to maintain high rates of growth in its online store, but it’s still showing a lot of potential. Lower selling prices are attracting more customers, as the growth in paid units accelerated to 12% year over year in Q3.

Ultimately, Amazon’s advantage centers around its prime membership program. All of the benefits Amazon

continues to stack around prime, including access to grocery delivery and medical prescriptions through

RxPass, make it very difficult for customers to cancel their membership. Amazon said it has more than

200 million Prime members in 2021, but it’s still growing. paid membership growth accelerated in Q3,

driving a year over increase in subscription revenue off 11%.

most impressive about Amazon is its success developing profitable revenue streams outside of its core

retail service, such as its cloud computing division (Amazon web services). Amazon originally developed

its cloud service to support the growth of its online stores, but as it turned out, there was a huge market

for this service outside of the company. Amazon web Services is now generating annual revenue of $103 billion.

The profitable growth from cloud, and recent efforts to lower costs, helped Amazon bring in $50 billion

in net income over the last year. Its continued investment in new fulfillment centers and AI capabilities

shows there are still tremendous opportunities to grow and reward Amazon investors for many years.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple consider this:

the motley Fool stock Advisor analyst team just identified what they believe are the 10

best stock for investors to buy now… and Apple wasn’t one of them. the 10 stocks that

made the cut cloud produce monster returns in the coming years.

consider when Nvidia made this list on April 15,2005… if you invested %1,000 at the

time of our recommendation, you’d have $843,960!

Now it’s worth nothing stock advisor’s total average return is 884$- a market-crushing

out performance compared to 175% for the S and P 500. don’t miss out on the latest top 10 list.